Wednesday, July 21, 2021

Ethics And The Food Delivery Business

Wednesday, July 3, 2019

Lee Iacocca (1924-2019)

Lee Iacocca died yesterday at the age of 94.

When I was a child, Iacocca was the first businessman of whom I became aware. He was an outsized personality and I recall our family telling jokes with the loud punchline of "I'm Lee Iacocca!!".

Mom, in particular, used to talk about him a lot. I think she admired his self-confidence and positivity. I noticed in his obituary that he was born in Allentown, so perhaps she also liked the Pennsylvania connection. I'm curious to ask her why she was fascinated by Iacocca.

According to the article in this morning's Post (here), Iacocca was a central figure in the American economy of the 1970's and 1980's. He first worked for Ford, where he was noticed and promoted by Robert McNamara. Here's a great anecdote that helps explain Iacocca's knack for sales and marketing:

“I decided that any customer who bought a new 1956 Ford should be able to do so for a modest down payment of 20 percent followed by three years of monthly payments of $56,” Mr. Iacocca wrote in his memoir. “I called my idea ’56 for ’56.’ ”

The plan was so successful that in three months, sales of Fords in the Philadelphia district shot to first place from last. McNamara so liked the idea that he made it part of Ford’s national marketing strategy. The company later estimated that the idea was responsible for selling 75,000 additional cars.After clashing with Henry Ford II, Iacocca became the chairman of Chrysler in 1978. He convinced Jimmy Carter to approve a bailout of Chrysler in 1980, and then he promptly repaid the government's loan seven years ahead of schedule!

Iacocca's death, along with George Bush's death last winter, marks the passing of a generation of American leaders. For all his cockiness and bravado, I greatly admire his work ethic and old-fashioned values (such as his pride that Chrysler repaid its loan early).

Thursday, June 20, 2019

The Miracle of Bodo's

Yesterday I realized that the cost of lunch has increased, across the board. Whereas a restaurant sandwich (or a salad, or a burger and fries at a fast food restaurant) used to cost $5.00 to $6.00, the same meal is now $7.00 to $9.00. I'm uncertain about the timeframe that this increase has occurred, but probably within the past 4-5 years.

The change in prices holds true everywhere, from chain restaurants to various local establishments.

EXCEPT for one amazing exception: Bodo's.

Somehow, a bagel sandwich at Bodo's still costs $5.00, and it's still every bit as good as it was ten years ago. How have they managed to hold their prices steady? (Meanwhile, they also continue to have a very loyal workforce -- I often recognize employees that have worked there for at least a decade)

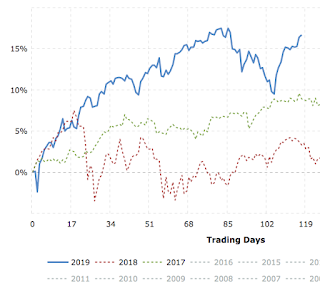

Speaking of questions about the economy, and taking the lens to a national scale, I remain curious about when the stock market will finally run out of steam.

After its short-term correction last fall, the market is again charging ahead (up about 15% year-to-date). I just don't see how the economy's growth can continue, and I anticipate a more significant market decline within the next six months.

Monday, July 24, 2017

Three Square Market: Microchips in the Body

The chips will allow people to open automatic doors, pay for purchases, login to computers, and store medical information.

I had a feeling these kind of chips would be used eventually, but I would not have predicted it to happen so soon. How quickly will this technology spread?

Elsewhere on the "future front", I recently saw a headline that Lyft will offer rides with driverless cars before the end of 2017.

Since the rise of smart phones, I have realized that new technologies can spread (and, indeed, become ubiquitous) very quickly. I'm not sure whether implanted microchips or driverless cars will be common within the next ten years, but I am starting to think it is possible.

Sunday, January 29, 2012

Differering Perspectives on Online Reviews

A patient got into a billing dispute with the dentist and -- ignoring the agreement -- posted angry reviews online. The dentist was perturbed enough to file suit.

The article goes on to examine more broadly the differing perspectives (patients versus physicians) when it comes to online review sites.

The common law claims by an aggrieved doctor/dentist/reviewee (who feels that he or she has been unfairly maligned online) are defamation and/or libel. It sounds like these claims can be quite difficult to prove, so some physicians have taken a creative approach:

Federal law protects Web sites from liability for the reviews its users publish. But the law carves out exceptions for intellectual property rights, including copyright. So Medical Justice’s contract assigned copyright in a patient review to the doctor, enabling the doctor to claim copyright infringement and demand that a Web site remove the comments.

These disputes raise interesting questions about moral and legal obligations related to (1) privacy and (2) a consumer's "right" to criticize a service provider in a forum that is basically unregulated and forms a permanent record.

516. Where should we draw the legal line in terms of allowing people to "say anything" online? Emily Bazelon has been examining this question in terms of schools that want to prohibit their students from criticizing and name-calling other students on Facebook.

517. Does the answer depend on whether the reviewer gives his/her real name versus remaining anonymous?

518. Are there any attorney online review sites? If not, why are their so many sites for doctors but none for lawyers?

519. Unrelated, but how much has the traffic on the Times's website decreased since the paper implemented its paywall? We cancelled our subscription at the beginning of January so I am dealing with the effects of the paywall for the first time. It is more powerful than I anticipated.

Thursday, August 5, 2010

Jan Hatzius: A Pessimistic Outlook for the American Economy

According to a piece by Nelson Schwartz in today's Times (here), Hatzius is extremely pessimistic about the US economy. He forecasts increased unemployment and possibly deflation in the next year or two.

Schwartz's article says that Commerce Department statitistics show Americans saving 6.4% of after-tax income, versus 1% in the years before the great recession. I gather that the increased savings is part of the reason it's going to be hard to break out of the recession, and frankly I'd rather have people saving more, even if it means the economy recovers more slowly.

Hatzius says there needs to be more deleveraging (again, I agree 100%), but I wonder who he suggests does the deleveraging: investment banks like his own employer or individual consumers who are overly indebted?

Hatzius predicts unemployment at 9.7% at the end of 2011, whereas the more optimistic Richard Berner predicts 8.7%. I think Hatzius will be closer on his prediction; I just don't see where a major expansion in jobs would come from, and I think the likelier path is that companies will continue to sporadically downsize in an effort to maximize profits.

On the issue of deflation, Paul Krugman continues to advocate for a massive second stimulus, and I just do not think that's the answer (I also am bothered by Krugman's "I'm smarter than you" presentational style). I think too much government stimulus would re-inflate the economy in an artificial way that might lead to another good decade but that ultimately would come back to bite us again.

458. What, then, are the promising "solutions" for creating more jobs? Is it all about alternative energy (as per Thomas Friedman), or are there other economic sectors in which a huge number of people could be employed and contribute meaningfully to improving society (and not just to re-stimulating consumption)?

Saturday, April 24, 2010

Questions About the Financial Reform Legislation

For the past couple of weeks, a major story has been President Obama's push to pass financial industry reform legislation. Some of my questions about it:

For the past couple of weeks, a major story has been President Obama's push to pass financial industry reform legislation. Some of my questions about it:432. Mark Warner seems to be one of the Democrats who is leading the charge. Did he volunteer to take a major role on this legislation, or was he recruited based on his own background as a businessman?

433. Will any of the Republicans break ranks when the cloture vote occurs on Monday? Bob Corker, perhaps -- he's been involved in negotiating it, and he contradicted Mitch McConnell's claim that the $50 billion bank-funded reserve is a recipe for future bailouts. What about my old fave moderates, Susan Collins and Olympia Snowe?

434. What will be the enforcement mechanism for the new regulations? I understand there's going to be an empowered consumer financial protection agency, but will the other new regs be overseen by the SEC or some other entity?

435. Tom Perriello appeared on Rob Schilling's show this week to debate the health care legislation -- we listened to the podcast of it and I thought Tom was outstanding in rationally responding to the Republican critiques. I continue to enjoy Schilling's show most of the times I hear snippets, even though I disagree with the majority of his politics -- what percentage of the show's listeners are non-conservatives?

436. The Obamas are in Asheville, North Carolina for a relaxation weekend. What are they doing with their brief bit of free time? Is he golfing? Reading a lot? Does he jog at all?

Saturday, April 10, 2010

The New Republic Sets Up a Paywall

This morning I was reading an article about Justice John Paul Stevens on The New Republic's website. Stevens announced his retirement this week and there has been an outpouring of positive portrayals -- and the TNR article promised to examine the reasons for so much adulation.

This morning I was reading an article about Justice John Paul Stevens on The New Republic's website. Stevens announced his retirement this week and there has been an outpouring of positive portrayals -- and the TNR article promised to examine the reasons for so much adulation.Alas, I got two paragraphs into the article and discovered that TNR has set up a paywall!!

My two reactions:

1. This is a bummer. I'd recently begun reading TNR quite frequently and was really enjoying their analysis. The writers seem not to try quite as hard as Slate's writers to be counter-intuitive // go-against-the-grain.

2. This is a very interesting development. TNR must have decided they were not willing to (or couldn't, financially) maintain the all-free model, and so it raises the question of whether other similar sites will follow their lead. From my perspective, I'll stop reading TNR as much (their blogs and certain content will remain free, but the "long form" articles will require a subscription), because there are plenty of free alternatives (Slate, The Atlantic, The Daily Beast, Real Clear Politics, etc.). How many consumers will respond like me, versus how many will pony up and subscribe?

TNR's Editor Franklin Foer (here) gives a not very satisfying answer to the question of "why?," which makes me think this was largely a financial decision:

429. What is the reason that Justice Stevens has received more positive attention than any other justice I can remember (even more than Sandra Day O'Connor at her retirement)?There’s also a deeper philosophical question: We charge our subscribers for our print journalism, because these are pieces that often require many months of reporting, writing, and editing. This style of journalism hasn’t exactly flourished in recent years, but it is at the core of our enterprise—and the reason many of us work at TNR. If we are so willing to place a price tag on such journalism in print, then why would we give it away in some other medium? We don’t have a good answer to that question. That’s the reason that we’re introducing the TNR Society. To read our “premium” content—namely, our print pieces and the bulk of our 96 years of archives—you’ll need a subscription.

Saturday, February 6, 2010

Problems with Toyotas; The Hangover (2009)

For about a week now, Toyota has dominated not only the business news but the front pages in general.

For about a week now, Toyota has dominated not only the business news but the front pages in general.There have been 8 to 9 million Toyota cars recalled. The issue, as I understand it, is that the accelerator pedals engage on their own.

I do not remember hearing about it but there was an incident at the end of last summer in which four people were killed (after their car acclerated on its own). A big part of the story is that neither Toyota nor the government safety agencies are clear on what's causing the problem: initially the explanation was the floor mats, and now there's a debate over whether it's actually an electronic (software) malfunction. There's also discussion about whether Toyota may have covered up several years worth of customer complaints about malfunctions.

A couple of days ago it came out that the Prius is also subject to braking issues, and this made the story even bigger; this morning the Post reports (here) that the hybrid braking story has broadened to encompass Ford's models (the Fusion and Milan) as well.

This picture is of Akio Toyoda; it's by Everett Kennedy Brown and is in today's Times.

This picture is of Akio Toyoda; it's by Everett Kennedy Brown and is in today's Times.

Yesterday, Toyota's chairman gave a fairly dramatic news conference in which he acknowledged the problems and said that they'd be addressed. The chairman is Akio Toyoda - he is the grandson of the founder and took the helm last summer.

The snow is coming down this morning, but it looks like the total amount may be less than anticipated -- more like 15 inches than 25? It's really beautiful. I went outside for walks and shoveling multiple times yesterday, so fun to just look at the snow, the trees, the streets all covered in it. It refreshes and quiets. It's water in a different way, and everything looks so pure.

---------

We watched a highly amusing movie last night: The Hangover. Great one-liners, particularly some non-sequiturs by Zach Galifianakis. Ed Helms was my favorite character (the scenes with his nagging girlfriend were priceless), and Mike Tyson's air-drumming of Phil Collins was awesome.

Saturday, January 30, 2010

Fannie and Freddie are Getting Tough; Ian Buruma on Google Versus China

According to an article in this morning's Wall Street Journal, Fannie Mae and Freddie Mac are becoming more agressive in compelling lenders to re-purchase mortgages which contain improper/incomplete/false documentation about the borrower.

According to an article in this morning's Wall Street Journal, Fannie Mae and Freddie Mac are becoming more agressive in compelling lenders to re-purchase mortgages which contain improper/incomplete/false documentation about the borrower.Freddie required $2.7 billion in such buy-backs during the first nine months of 2009, versus $1.2 billion for the same period in '08.

Nick Timiraos says that Fannie and Freddie are feeling the heat to put the screws on lenders who didn't do their due diligence:

This article/trend backs up what I am seeing in terms of lenders scutinizing potential borrowers extremely closely nowadays: banks have clearly gotten the message that they had better look real hard at each borrower's financials before approving an application.The get-tough stance comes amid pressue on Fannie Freddie to make the most out of more than $100 billion in taxpayer funds they got to stay afloat.

I'm curious to know what legal process happens when a bank is required to buy-back a mortgage from Fannie or Freddie. Does money change hands, or just the note itself? Are attorneys involved? $2.7 billion isn't actually that much money in the grand scheme of the US housing market, so I imagine that each time a loan is bought-back by one of the banks it is a (relatively) big deal.

In another article in The Journal, Ian Buruma (here) puts the Google-China dispute in the larger context of the historical efforts by the Chinese to prevent Western ideas and ideologies from overtaking their culture.

The Chinese leaders who are pushing back on Google are accusing it and the US government of engaging in "information imperialism" - this is a term I have not previously heard. Here's an excerpt:

The term "information imperialism" is clearly designed to evoke memories of the Opium Wars and other historical humiliations. Chinese are meant to feel that foreigners who talk about human rights are doing so only to bash China. This is not always entirely irrational. If Chinese chauvinism is defensive, American chauvinism can be offensive.

Saturday, January 23, 2010

Chrysler and GM Dealership Arbitration

I haven't written about the US auto industry for quite a while. For the past several months, the primary business focus has been back on banking - with growing criticism from left and right that Obama has not done enough to shake-up and/or re-regulate the industry.

I haven't written about the US auto industry for quite a while. For the past several months, the primary business focus has been back on banking - with growing criticism from left and right that Obama has not done enough to shake-up and/or re-regulate the industry.Looking back, my earlier posts on the car crisis were as follows:

April 17, 2009 (here): "It seems as though Chrysler might become the sacrificial lamb of the US auto industry, although maybe public pressure will compel the four banks to agree to an "unfair" (!) deal." -- Well, I was wrong that Chrysler would go it alone down the path of bankruptcy; I guess I thought then that the government would compel a GM solution.

May 17, 2009 (here): "Yesterday's Times included a sad anecdote about a Kentucky dealership that had recently been awarded a "50 year" certificate (from Chrysler, I think) -- then, just a couple of months later, it's being cut loose. I get the impression from the coverage that some dealers might take legal action to try to block revocation of the franchises, but it sounds like they'd be fighting an uphill battle particularly in light of Chrysler's having filed for bankruptcy protection." -- This brings me to today's update. An article in this morning's Times (here) says that the arbitration hearings for Chrysler and GM dealers who are protesting their revocations will occur in the next couple of months.

Nick Bunkley writes that GM's CEO (Edward Whitacre) has signaled they might re-grant the dealerships to "hundreds" of dealers. But Sergio Marchionne of Chrysler (he's the Fiat guy) is taking a different tack:

Marchionne, who was not involved in the company when the cuts were made, nonetheless defended them this month during a speech to an industry conference. “The decision that we made, I think it was made with diligence, it was made equitably, and I think it was done fairly,” Mr. Marchionne said. “What I cannot do is unwind the last seven months of history, during which Chrysler went on and started rebuilding a distribution network on the assumption that the ruling of the bankruptcy judge was final.” He added, “My conscience is clear.”GM cut 1,300 dealers and Chrysler cut 789. Whereas GM gave most of their eliminated dealers until this coming fall to shut down operations, many of the Chrysler dealerships only had 4 weeks to do so.

As of Friday afternoon, 915 dealers had filed to contest their termination, according to an executive with the American Arbitration Association, which is overseeing the review process.

Monday, January 11, 2010

Unemployment

It looks like the biggest economic story of 2010 will continue to be unemployment.

It looks like the biggest economic story of 2010 will continue to be unemployment.Last week the data came out for December. The US lost 85,000 jobs (which was considerably more than most economists had predicted), and the current rate of unemployment is 10.0%.

The chart is from the Bureau of Labor Statistics website.

In Charlottesville, a printing plant that does work for Lexis announced that it is closing. The plant is located on Carlton Avenue and is owned by Cenveo (a national company); 61 employees will be put out of work (Bryan McKenzie has the story for the Progress here).

Sunday, December 27, 2009

Robert Shiller's Proposal for Trills

Here's an economic proposal that's way outside the box: Robert Shiller says that the US government should sell equity shares in our gross domestic product.

Here's an economic proposal that's way outside the box: Robert Shiller says that the US government should sell equity shares in our gross domestic product.Shiller calls the shares "trills." Each trill would represent one-trillionth of the United States G.D.P., and it would pay a dividend equal to one-trillionth of that year's G.D.P. He argues that trills could become a new source of funds for the government. I am unclear on how the fundraising aspect would work, although I assume the initial sale of the trills would be similar to the way in which an IPO generates funds for a company.

Shiller writes about trills in today's NYT, here. He says that for 2009 a trill would return $14 in dividends and cost in the range of $1,400 (thus representing approximately a 1% annual yield).

I am curious as to the nature of other economists' objections to this idea. Is the problem that a market in trills would make it too easy to gamble on the fluctuations in the US economy, thus increasing instability?

Would trills make it too easy for other nations to acquire a "stake" in the US government? This can't be the objection, since the Chinese (among others) already control an enormous debt stake.

Saturday, December 26, 2009

American Capitalism at Decade's End

There's an article on the front page of today's Times (here) about the exceedingly low amounts of interest being paid for savings accounts, money market accounts, and CD's at the moment.

There's an article on the front page of today's Times (here) about the exceedingly low amounts of interest being paid for savings accounts, money market accounts, and CD's at the moment.Many of the large banks are paying between 0.5 and 1.5% on these accounts/CD's, and the conspiratorial theory is that the Fed is keeping interest rates so low in order to compel people to invest in the stock market (as a higher-yield alternative), thereby leading to the continuing upswing in the stock market.

Other news from the business world recently:

- Some AIG employees who orally promised to return some of their bonus payments from March 2009 (which raised such a huge protest at the time) are now arguing that they will not do so unless the federal government makes certain promises of its own about future bonuses. I'm unclear as to what the AIG employees want, but the implicit threat appears to be that if they are compelled to leave the company it will be that much harder to finish "unwinding" all the derivatives.

- An article in yesterday's Times said that Goldman Sachs was simultaneously selling mortgage-backed securities to many of its clients and then short-selling the same securities (or the broader mortgage market).

- The amusement park industry has been hurting in America during the recession, but it's growing at the moment in certain Asian contries (including Singapore and Malaysia).

- There's a good article in today's Business section (here) about how some of the popular microfinance sites work; the big ones include Kiva, Microplace, and Modest Needs. Actually, Modest Needs sounds less like microfinance and more like individually-targeted charitable donations, and it's interesting how they've structured it to make the donations still eligible for the federal tax decuction. One of the main points of the article is that Kiva and Microplace donations do not go directly to the borrowers but rather to the financing institutions as a conduit.

Tuesday, November 24, 2009

General Motors Update: Edward Neidermeyer Argues That US Taxpayers Will Lose Big

It's been about six months since General Motors declared bankruptcy, and I can't tell if the company's fortunes have improved or declined since the government bailout.

It's been about six months since General Motors declared bankruptcy, and I can't tell if the company's fortunes have improved or declined since the government bailout.Edward Neidermeyer, though, has an opinion: he says that GM's (and the government's) upbeat announcements last week are hogwash. In a piece in yesterday's New York Times (here), Neidermeyer says that US taxpayers aren't going to recover anything close to their investment in GM.

Niedermeyer reports that the US Treasury has invested approximately $52 billion in GM during the past year. Therefore, Fritz Henderson's announcement last week that GM would pay back $6.7 billion was more propaganda than substance. The only way for taxpayers to actually be made whole would be via an initial public offering (of new GM stock) succeeds beyond anyone's wildest dreams:

Any hope of an I.P.O. completely repaying taxpayers is wildly optimistic. Even before Mr. Henderson hinted at a timeline, a Government Accountability Office report pointed out that G.M. would have to attract a market capitalization of $66.9 billion for taxpayers to recoup the government’s investment. Sorry, but that’s a pipe dream: G.M. has never been worth more than $57 billion, and that was in the salad days of 2000.It's interesting because during the past month there has been tons of talk about populist anger at Wall Street and how that anger is going to make it difficult for the Democrats in 2010, but very little of the commentary has focused on the auto company bailouts. Is GM getting a free ride while Goldman and Citibank take all the heat?

373. What role is Fiat playing in running (or owning) GM? I wrote about Fiat becoming a major player (May 17, here), but I haven't heard all that much about the Italians since. Does Fiat management get to take part in major strategic decisions? Is GM producing Fiat cars (or vice versa)?

Thursday, November 12, 2009

George Will's Worried About the Deficit (Could The OMB Learn Some Lessons From Gary O'Connell?)

George Will is worried about the ever-increasing deficit, and I am with him. In today's Post (here), Will complains about how much money the Federal Reserve is printing in its frantic effort to keep the economy going.

George Will is worried about the ever-increasing deficit, and I am with him. In today's Post (here), Will complains about how much money the Federal Reserve is printing in its frantic effort to keep the economy going.Will predicts inflation around the corner: "The U.S. government has a powerful incentive to try to use controlled inflation for the slow-motion repudiation of some of its mountain of new debt."

There are not that many pundits complaining about the deficit at the moment, and I can't quite figure out why.

353. Have all the commentators been cowed by Paul Krugman's repeated calls for more and more stimulus? Are they concerned that advocating belt-tightening while we are still in the recession would be considered irresponsible? Or is it actually the consensus of mainstream economists to keep printing money as fast as the Chinese and other countries will buy it?

If I think about long-term problems confronting the US right now, the biggest one is clearly climate change, and #2 is probably the threat of radical theologies. But third on the list could definitely be the possibility of the collapse of the dollar (and, with it, the American economy), once the Fed has to eventually pull the plug on cheap money.

Interestingly, the City of Charlottesville continues to run a tight budgetary ship, as evidenced by the newly-announced fiscal 2009 surplus (!) -- Rachana Dixit's got the story in the Progress, here. Big props to whoever is running the City budget!

Tuesday, October 6, 2009

Simmons Beauty Rest: A Critique of Private Equity

In yesterday's NYT (here), Julie Creswell tells the sad story of Simmons Bedding Company, which plans to file for bankruptcy in the next few weeks.

In yesterday's NYT (here), Julie Creswell tells the sad story of Simmons Bedding Company, which plans to file for bankruptcy in the next few weeks.Creswell's piece is well-reported: she has plenty of details about the economics of the M&A world, but she also includes snapshots of the human characters (including a private equity titan, a laid-off employee, and the company founder) whose actions and decisions collectively tell a "corporation's" story (reminding me of John Steinbeck, in The Grapes of Wrath, writing about "The Bank" but also telling the individual human stories of the Joads and others).

- A private equity firm purchases a company at a premium during the boom years

- The private owners then overleverage the acquired company, using the new debt to pay themselves hefty dividends

- Ultimately, the acquired company has such a massive debt load that it can no longer sustain profitable operations

Thomas H. Lee Partners bought Simmons in 2003 for $1.1 billion (of which $745 million was debt- financed), then refinanced twice and withdrew much of the company's equity (in the form of dividends to themselves). The dividends, combined with fees, have enabled THL to make a $77 million profit while the company's fortunes have cratered.

Incidentally, Thomas H. Lee's claim to fame was flipping Snapple to Quaker Oats for $1.7 billion (having paid only $130 million two years earlier). I remember the Snapple story from when I was in college -- it was told as one of the examples of how private equity firms could contribute to economic growth and dynamism.

Longtime employee Noble Rogers tells a sad story of Simmons's management having no sympathy for him or other employees (approximately 25% of all employees) who were laid off. The sources at THL blame the economic downturn for Simmons's problems and absolve themselves of responsibility. Creswell relies on the numbers to counter THL's explanation, but Noble Rogers describes what happened in more straightforward terms:

“They stopped the picnics. They stopped the Christmas parties. They stopped the retirement parties,” he recalled. “That showed you the type of people I was working for. I just didn’t realize it until the hard times came like they did.”

Wednesday, September 30, 2009

The Latest on the Economy: Case-Shiller and the Conference Board

It's hard to get a handle on which way the economy is headed.

It's hard to get a handle on which way the economy is headed.The stock market has held onto the gains of the spring and summer (and some stocks have even continued to rise - I'm thinking here of GE and Intel), and many commentators seem to think a turning point has been reached. I think even Ben Bernanke announced an official "end" of the recession a couple of weeks ago.

But, the unemployment situation remains incredibly bad and certain writers are not at all optimistic (the cover story in a recent New Republic argued that the government is fast-laying a groundwork for the next crash, and Daniel Gross is convinced the real estate market remains a disaster).

In this morning's Washington Post, Dina ElBoghdady reports on two data points released yesterday which illustrate the continuing uncertainty:

- The Case-Shiller index showed a 1.6% increase in home prices from June to July -- the third straight monthly increase (however, prices are 13.3% lower, nationally, than they were at the same time last year)

- The Conference Board's consumer confidence index unexpectedly dipped from August to September

Tuesday, September 15, 2009

Judge Jed Rakoff and the Bank of America / S.E.C. Settlement

Judge Jed S. Rakoff rejected (!) the $33 billion settlement proposal between the S.E.C. and Bank of America.

Judge Jed S. Rakoff rejected (!) the $33 billion settlement proposal between the S.E.C. and Bank of America.This is the case involving allegations that Bank of America's board withheld information from shareholders that may have been relevant in their consideration of whether to approve the Merrill Lynch acquisition.

Rakoff suspects that both sides were using the proposed settlement to bury the story, and he's not having it. Here's Zachary Kouwe's summary in today's NYT:

He accused the S.E.C. of failing in its role as Wall Street’s top cop by going too easy on one of the biggest banks it regulates. And he accused executives of the Bank of America of failing to take responsibility for actions that blindsided its shareholders and the taxpayers who bailed out the bank at the height of the crisis ...

The judge accused Bank of America and the S.E.C. of concocting the settlement to effectively absolve themselves of further responsibility. “The S.E.C. gets to claim that it is exposing wrongdoing on the part of the Bank of America in a high-profile merger,” he wrote, and “the Bank’s management gets to claim that they have been coerced into an onerous settlement by overzealous regulators.”

Monday, September 14, 2009

Government Intervention in the Economy

It's easy to forget how significantly the government's role in the economy has changed during the course of the past year.

It's easy to forget how significantly the government's role in the economy has changed during the course of the past year. Edmund Andrews and David Sanger, in an article in the Times today (here), brought home to me the hugeness of the intervention:

- 9 out of 10 mortgages are now financed by the government; the Fed has purchased $700 billion in mortgage-backed securities.

- Government spending accounts for 26% of economic activity (the largest percentage since World War II).

- The government owns 60% of General Motors and 80% of AIG; the article says that some of the $20 billion TARP investment in GM and Chrysler will never be recovered (interestingly, the new CEO at AIG, Robert H. Benmosche, has a salary of $9 million (?!)).

- The FDIC guarantees $300 billion of bonds issued by banks.

- It's no wonder people are reluctant on health care reform: even for someone like me who reads all those Krugman articles about the importance of government spending during the crisis, the enormity of the government's intervention is rather overwhelming.

- Isn't all of the government lending just kicking-the-can-down-the-road on our country being overly-leveraged? (The writers address this issue thus: "As the government backs away from its rescue operations, economists and others worry about unknown consequences. Some analysts are already predicting that mortgage rates will bump higher when the Fed stops buying mortgage securities, potentially delaying a recovery in housing.")